1. Enterprise Risk Management (ERM) limitations

In today's digital transformation revolution and competitive business environment, business entities are faced with greater risks, on both sides (opportunities & threats). However current risk management frameworks show many limitations and weak points to align business strategies.

The limitations of ERM are represented in that it serves as a control framework extends corporate auditing to meet regulatory standards, which may hinder creative solutions and adaptive thinking due to its focus on compliance. Despite providing reasonable assurance regarding objective achievement, ERM faces challenges due to human judgment, errors, control circumvention, and management overrides, impacting its effectiveness. Critics argue that ERM has not delivered its promised benefits and call for a reevaluation of current risk management practices, citing weaknesses such as tendency to be reactive rather than proactive due to the failure to identify risks beforehand, disregard the valuable insights of insiders in controlling risks effectively. absence of a third dimension—cost of mitigation—essential for executives to make informed decisions on risk management and challenges in risk identification, and inadequate metrics.

2. Data Acquisition and Preprocessing:

Building a risk management framework integrated with an AI strategy requires a comprehensive approach to data acquisition and preprocessing. In steps a preprocess data for the framework:

3. Model Development:

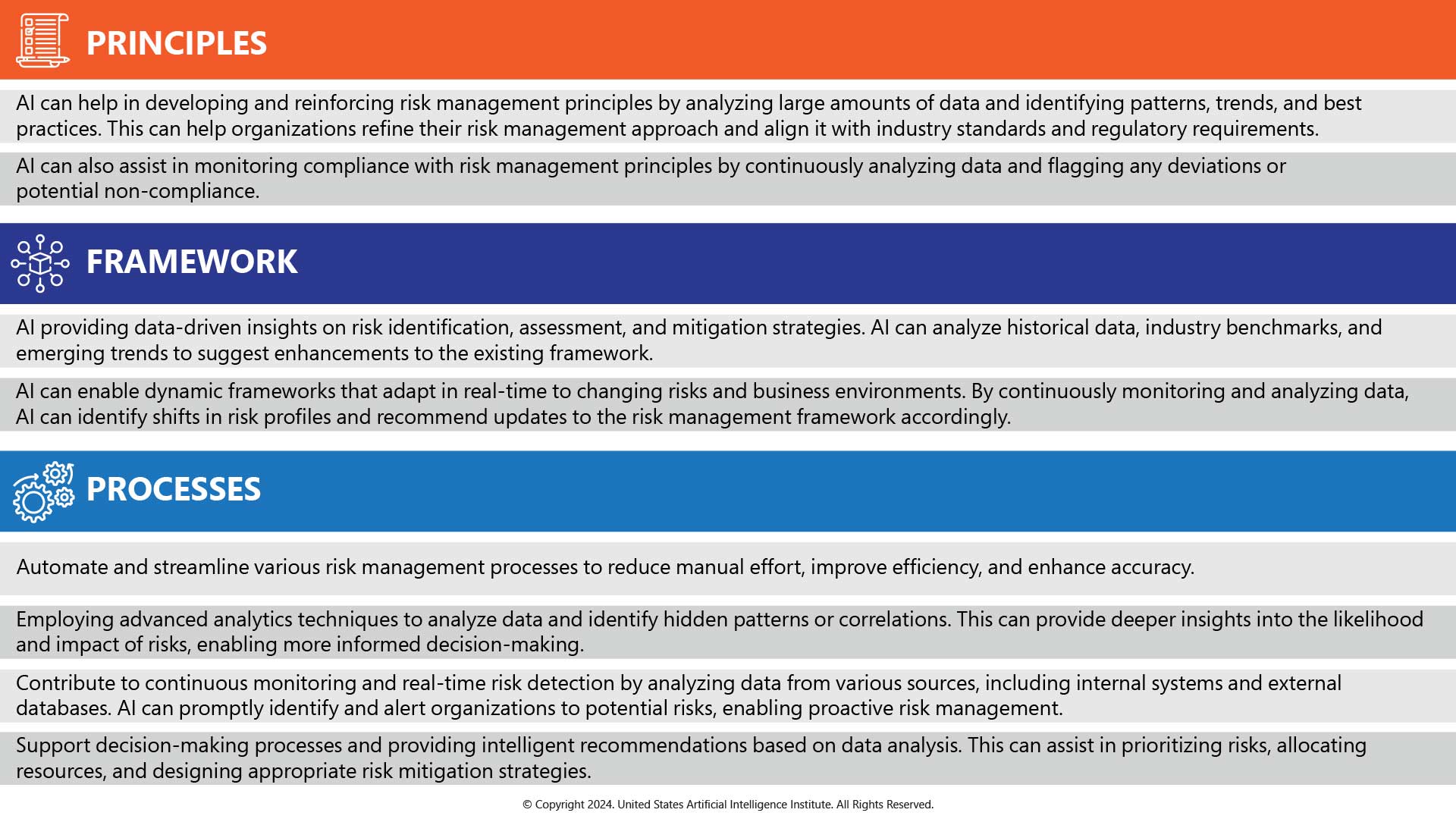

Principles, framework, and processes are the main pillars and components of ERM frameworks, where AI can enhance and contribute in various ways, and add more values:

4. Integration with Decision-Making Processes

Integrating AI with decision-making processes in risk management can enhance the efficiency, accuracy, and effectiveness of risk analysis and mitigation strategies. The integration points can include: automated risk prediction, anomaly detection, machine learning models, scenario analysis, real-time monitoring of risk factors, natural language processing (NLP) to analyze unstructured data sources, cognitive computing, AI-driven reporting and dashboarding. These AI technologies can improve decision accuracy and respond to risks in a timely manner. AI can also complement human judgment by providing data-driven insights and recommendations that support informed decision-making in managing enterprise risks.

5. Ethical and Regulatory Considerations

Integrating AI in risk management comes with several ethical and regulatory considerations that must be addressed to ensure responsible and compliant use of AI technologies. Here are some of the main ethical and regulatory considerations to keep in mind:

Conclusion:

Organizations’ need to enhance enterprise risk management frameworks with AI integration:

Follow us: